FROM OUR BLOG

FROM OUR BLOG

FROM OUR BLOG

Weather Data and Insurance: The Power of Early Warning in Decision Making

Aug 9, 2023

In our era of accelerating climate change, weather data has become a pivotal tool in the insurance industry’s decision-making processes. It offers the ability to predict and assess risk, enabling insurers to bridge the insurance gap and reduce costs. The potency of early warnings facilitated by accurate weather data cannot be overstated. It provides insurers with crucial insights about potential weather-related risks, informing proactive measures which can significantly reduce claims and minimize losses. This, in turn, contributes to more accurate pricing of insurance products, fostering a more resilient and sustainable insurance industry.

Weather Impact on Agriculture and Real Estate

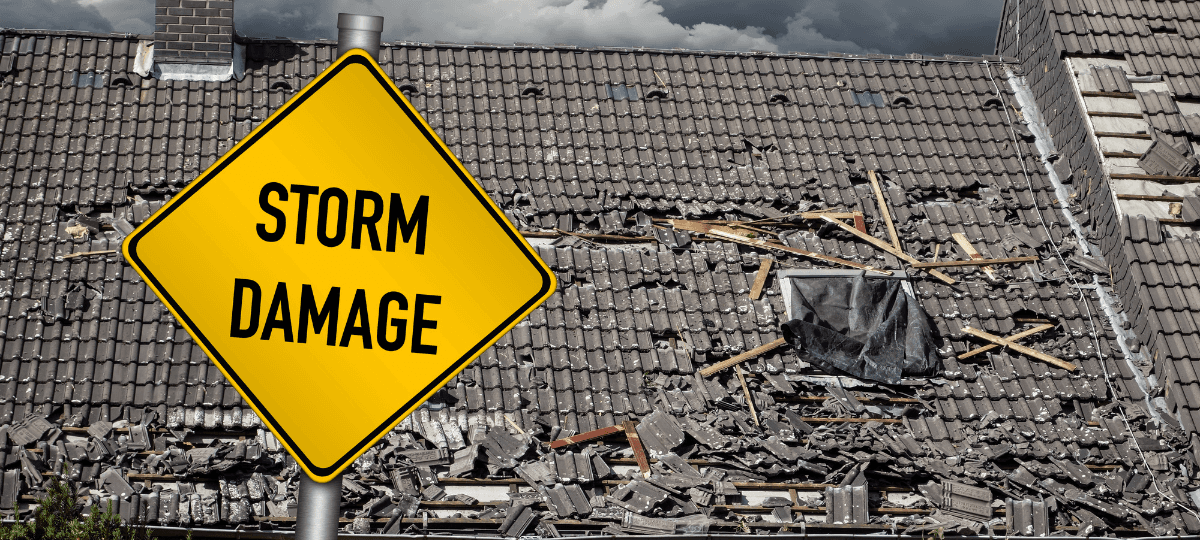

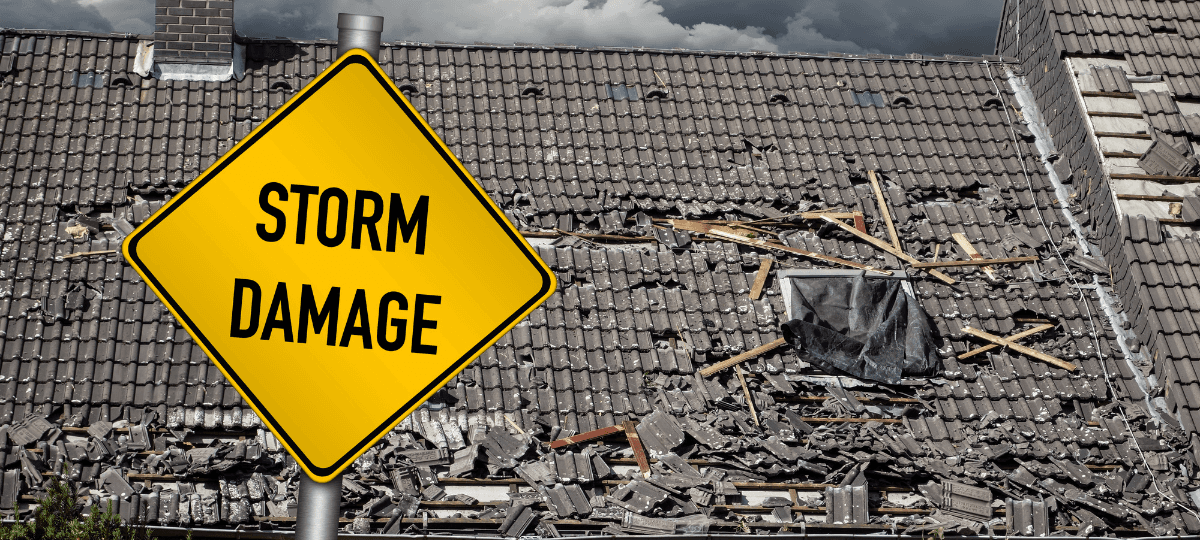

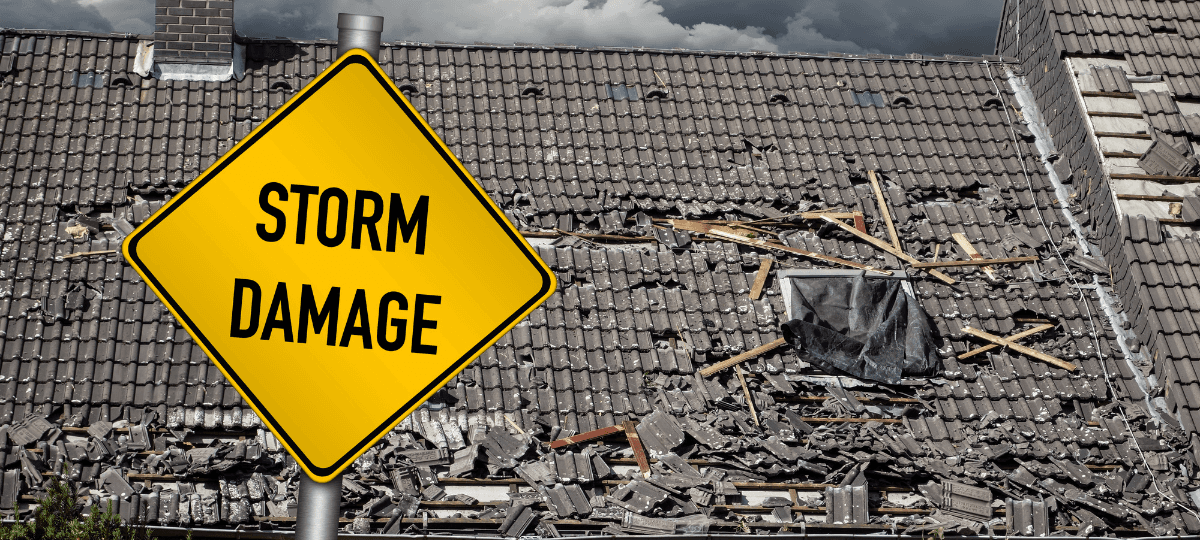

Climate change and weather fluctuations have a pronounced influence on both the agriculture and real estate sectors. In agriculture, weather extremes such as droughts, floods, and heatwaves can have devastating effects on crop yields, livestock health, and overall farm operations, leading to uncertain income and increased insurance claims. Accurate weather data allows insurers to anticipate these risks and adjust their policies accordingly, thereby reducing costs and filling the insurance gap in this volatile sector.

On the other hand, the real estate sector faces different weather-related challenges. Severe weather events, such as hurricanes, floods, or wildfires, can cause significant property damage, leading to substantial insurance claims. Moreover, long-term climate change can impact property values, especially in areas increasingly prone to these adverse events. Here too, early-warning systems facilitated by precise weather data play a crucial role. They enable insurers to accurately assess the risk associated with specific geographic locations and property types, leading to better risk evaluation, more accurate pricing, and ultimately, a more sustainable insurance industry.

The Power of Early Warning Systems

Early warning systems are essential tools that leverage a variety of data sources, predictive analytics, and modeling techniques to provide timely and effective alerts about potential adverse weather events. They work by continuously monitoring weather patterns and identifying signs of impending hazards such as hurricanes, floods, wildfires, or prolonged heatwaves.

These systems employ advanced algorithms and machine learning techniques to process vast amounts of weather data, identify patterns, and predict the likelihood of an event occurring based on those patterns. The results are then communicated effectively to relevant stakeholders such as insurance providers, enabling them to take proactive measures to mitigate risk.

In the context of insurance, early warning systems can help in anticipating the potential impact of weather events on insured assets and populations. They provide insurers with the lead time required to adjust their policies, deploy resources, communicate with policyholders, and take other actions that can help in reducing costs and filling the insurance gap. Thus, early warning systems are a powerful tool in the insurance industry’s arsenal, helping it to become more resilient and sustainable in the face of climate change.

The Role of Early Warning Systems in Predicting Damaging Weather Events

Early warning systems play a crucial role in predicting potentially damaging weather events. By analysing real-time weather data, these systems can forecast adverse weather conditions with a remarkable degree of accuracy. They are capable of identifying and interpreting patterns that could signify the onset of severe weather events, from devastating hurricanes to damaging floods and wildfires.

With the ever-present threat of climate change altering weather patterns, early warning systems have become an invaluable tool for insurance providers. They can provide early alerts, allowing insurers to promptly inform policyholders in the path of potential hazards. This proactive approach not only helps to reduce costs associated with weather-related damages but also assists in addressing the insurance gap.

These systems, therefore, hold the key to maintaining the sustainability of the insurance industry in an age of increasing climate unpredictability. They enable insurers to better understand and manage weather-related risks, ultimately resulting in more accurately priced policies and a more resilient industry.

Benefits to the Insurance Industry

The application of predictive data derived from early warning systems can significantly enhance the evaluation and management of risk in the insurance sector. With precise forecasts, insurers can assess the likelihood of a destructive weather event occurring and the potential scale of damage, allowing for a more accurate calculation of risk premiums.

Predictive data also supports the development of dynamic pricing models, where insurance premiums can be adjusted in response to fluctuating weather patterns. For instance, in regions showing increasing instances of floods or wildfires, insurers can accordingly adjust their policy rates.

Moreover, predictive data empowers insurers to actively manage risk by issuing timely warnings to policyholders. For example, if a severe storm is forecasted, insurers can alert policyholders to take preventative measures such as securing outdoor items or evacuating if necessary. These actions can minimize damage, reducing claim costs and hence, the overall financial burden on the insurer.

This strategic use of predictive data, therefore, not only reduces costs and addresses the insurance gap but also promotes a more proactive approach to risk management, leading to a more sustainable and resilient insurance industry in the face of climate change.

Cost-Saving Benefits and Customer Service Enhancement

Utilizing predictive weather data has proven to be a practical cost-saving measure for insurance industries. Immediate savings are realized through reduced claim costs, as early warnings enable policyholders to take protective measures against impending weather threats. This proactive approach lessens the extent of damage, and by extension, the value of the claim.

Furthermore, the incorporation of dynamic pricing models, adjusted in response to changing weather patterns, ensures a fairer distribution of risk and a corresponding reduction in the insurance gap. This approach results in fewer unexpected losses and the stabilization of costs over time.

Beyond monetary savings, the use of predictive data significantly enhances customer service. Timely alerts and advice on preventive measures create a more engaged relationship between insurers and policyholders. The insurer is perceived not merely as a financial safety net post-disaster, but as an active partner invested in the policyholder’s well-being. This shift promotes increased satisfaction and trust, which are crucial for customer retention in an increasingly competitive insurance market.

In conclusion, the integration of early warning systems into the insurance industry’s decision-making process leads to substantial cost reductions, improved risk management, and superior customer service, all of which contribute to industry resilience in the face of climate change.

Real-World Examples of Weather Data in Insurance Decision-Making

Prominent insurance companies have leveraged weather data and early warning systems to streamline their operations and increase profitability. For example, Munich Re, one of the world’s leading reinsurers, utilizes climate data to model and manage risks associated with extreme weather events. Through their Geo Risks Research unit, they analyze meteorological data to predict potential losses and adjust their underwriting and pricing strategies accordingly.

Another notable example is Swiss Re, which uses sophisticated weather models to design insurance products that automatically pay-out when certain weather conditions are met. This not only reduces the administrative costs associated with traditional claim processes but also ensures swift financial support to policyholders after a weather disaster.

Finally, AXA, a global insurance giant, has integrated weather data into their digital platforms to provide policyholders with real-time alerts of approaching severe weather. This proactive approach allows policyholders to take necessary precautions, minimizing potential damages and ultimately reducing claim costs for AXA. These examples illustrate the transformative impact of weather data and early warning systems in the insurance industry.

Conclusion

The use of weather data in insurance decision making has proven to be a game-changer, facilitating cost reductions, improved risk management, and enhanced customer service. Companies like Munich Re, Swiss Re, and AXA have successfully harnessed this data to predict risks, design innovative products, and provide real-time alerts to their policyholders.

Looking to the future, we can expect an increasing reliance on advanced weather modelling and early warning systems given the escalating risks posed by climate change. As more insurers recognize the potential of this data to close the insurance gap and reduce costs, we anticipate increased investment in data analytics capabilities. In particular, real-time weather tracking and forecasting could become an industry standard, enabling insurers to better anticipate and manage risks. Additionally, the integration of machine learning and artificial intelligence could unlock further potential, automating risk assessments and claim processes, thereby delivering even greater efficiency and cost savings.

In our era of accelerating climate change, weather data has become a pivotal tool in the insurance industry’s decision-making processes. It offers the ability to predict and assess risk, enabling insurers to bridge the insurance gap and reduce costs. The potency of early warnings facilitated by accurate weather data cannot be overstated. It provides insurers with crucial insights about potential weather-related risks, informing proactive measures which can significantly reduce claims and minimize losses. This, in turn, contributes to more accurate pricing of insurance products, fostering a more resilient and sustainable insurance industry.

Weather Impact on Agriculture and Real Estate

Climate change and weather fluctuations have a pronounced influence on both the agriculture and real estate sectors. In agriculture, weather extremes such as droughts, floods, and heatwaves can have devastating effects on crop yields, livestock health, and overall farm operations, leading to uncertain income and increased insurance claims. Accurate weather data allows insurers to anticipate these risks and adjust their policies accordingly, thereby reducing costs and filling the insurance gap in this volatile sector.

On the other hand, the real estate sector faces different weather-related challenges. Severe weather events, such as hurricanes, floods, or wildfires, can cause significant property damage, leading to substantial insurance claims. Moreover, long-term climate change can impact property values, especially in areas increasingly prone to these adverse events. Here too, early-warning systems facilitated by precise weather data play a crucial role. They enable insurers to accurately assess the risk associated with specific geographic locations and property types, leading to better risk evaluation, more accurate pricing, and ultimately, a more sustainable insurance industry.

The Power of Early Warning Systems

Early warning systems are essential tools that leverage a variety of data sources, predictive analytics, and modeling techniques to provide timely and effective alerts about potential adverse weather events. They work by continuously monitoring weather patterns and identifying signs of impending hazards such as hurricanes, floods, wildfires, or prolonged heatwaves.

These systems employ advanced algorithms and machine learning techniques to process vast amounts of weather data, identify patterns, and predict the likelihood of an event occurring based on those patterns. The results are then communicated effectively to relevant stakeholders such as insurance providers, enabling them to take proactive measures to mitigate risk.

In the context of insurance, early warning systems can help in anticipating the potential impact of weather events on insured assets and populations. They provide insurers with the lead time required to adjust their policies, deploy resources, communicate with policyholders, and take other actions that can help in reducing costs and filling the insurance gap. Thus, early warning systems are a powerful tool in the insurance industry’s arsenal, helping it to become more resilient and sustainable in the face of climate change.

The Role of Early Warning Systems in Predicting Damaging Weather Events

Early warning systems play a crucial role in predicting potentially damaging weather events. By analysing real-time weather data, these systems can forecast adverse weather conditions with a remarkable degree of accuracy. They are capable of identifying and interpreting patterns that could signify the onset of severe weather events, from devastating hurricanes to damaging floods and wildfires.

With the ever-present threat of climate change altering weather patterns, early warning systems have become an invaluable tool for insurance providers. They can provide early alerts, allowing insurers to promptly inform policyholders in the path of potential hazards. This proactive approach not only helps to reduce costs associated with weather-related damages but also assists in addressing the insurance gap.

These systems, therefore, hold the key to maintaining the sustainability of the insurance industry in an age of increasing climate unpredictability. They enable insurers to better understand and manage weather-related risks, ultimately resulting in more accurately priced policies and a more resilient industry.

Benefits to the Insurance Industry

The application of predictive data derived from early warning systems can significantly enhance the evaluation and management of risk in the insurance sector. With precise forecasts, insurers can assess the likelihood of a destructive weather event occurring and the potential scale of damage, allowing for a more accurate calculation of risk premiums.

Predictive data also supports the development of dynamic pricing models, where insurance premiums can be adjusted in response to fluctuating weather patterns. For instance, in regions showing increasing instances of floods or wildfires, insurers can accordingly adjust their policy rates.

Moreover, predictive data empowers insurers to actively manage risk by issuing timely warnings to policyholders. For example, if a severe storm is forecasted, insurers can alert policyholders to take preventative measures such as securing outdoor items or evacuating if necessary. These actions can minimize damage, reducing claim costs and hence, the overall financial burden on the insurer.

This strategic use of predictive data, therefore, not only reduces costs and addresses the insurance gap but also promotes a more proactive approach to risk management, leading to a more sustainable and resilient insurance industry in the face of climate change.

Cost-Saving Benefits and Customer Service Enhancement

Utilizing predictive weather data has proven to be a practical cost-saving measure for insurance industries. Immediate savings are realized through reduced claim costs, as early warnings enable policyholders to take protective measures against impending weather threats. This proactive approach lessens the extent of damage, and by extension, the value of the claim.

Furthermore, the incorporation of dynamic pricing models, adjusted in response to changing weather patterns, ensures a fairer distribution of risk and a corresponding reduction in the insurance gap. This approach results in fewer unexpected losses and the stabilization of costs over time.

Beyond monetary savings, the use of predictive data significantly enhances customer service. Timely alerts and advice on preventive measures create a more engaged relationship between insurers and policyholders. The insurer is perceived not merely as a financial safety net post-disaster, but as an active partner invested in the policyholder’s well-being. This shift promotes increased satisfaction and trust, which are crucial for customer retention in an increasingly competitive insurance market.

In conclusion, the integration of early warning systems into the insurance industry’s decision-making process leads to substantial cost reductions, improved risk management, and superior customer service, all of which contribute to industry resilience in the face of climate change.

Real-World Examples of Weather Data in Insurance Decision-Making

Prominent insurance companies have leveraged weather data and early warning systems to streamline their operations and increase profitability. For example, Munich Re, one of the world’s leading reinsurers, utilizes climate data to model and manage risks associated with extreme weather events. Through their Geo Risks Research unit, they analyze meteorological data to predict potential losses and adjust their underwriting and pricing strategies accordingly.

Another notable example is Swiss Re, which uses sophisticated weather models to design insurance products that automatically pay-out when certain weather conditions are met. This not only reduces the administrative costs associated with traditional claim processes but also ensures swift financial support to policyholders after a weather disaster.

Finally, AXA, a global insurance giant, has integrated weather data into their digital platforms to provide policyholders with real-time alerts of approaching severe weather. This proactive approach allows policyholders to take necessary precautions, minimizing potential damages and ultimately reducing claim costs for AXA. These examples illustrate the transformative impact of weather data and early warning systems in the insurance industry.

Conclusion

The use of weather data in insurance decision making has proven to be a game-changer, facilitating cost reductions, improved risk management, and enhanced customer service. Companies like Munich Re, Swiss Re, and AXA have successfully harnessed this data to predict risks, design innovative products, and provide real-time alerts to their policyholders.

Looking to the future, we can expect an increasing reliance on advanced weather modelling and early warning systems given the escalating risks posed by climate change. As more insurers recognize the potential of this data to close the insurance gap and reduce costs, we anticipate increased investment in data analytics capabilities. In particular, real-time weather tracking and forecasting could become an industry standard, enabling insurers to better anticipate and manage risks. Additionally, the integration of machine learning and artificial intelligence could unlock further potential, automating risk assessments and claim processes, thereby delivering even greater efficiency and cost savings.

More Update

Subscribe to our newsletter

Receive the latest weather intelligence, industry trends, and expert forecasts directly to your inbox

Subscribe to our newsletter

Receive the latest weather intelligence, industry trends, and expert forecasts directly to your inbox

Subscribe to our newsletter

Receive the latest weather intelligence, industry trends, and expert forecasts directly to your inbox